Related searches

Wells Fargo Cd Rates

Huntington Cd Rates

Discover Bank Cd Rates

American Express Cd Rates

Bmo Harris Cd Rates

Wells Fargo Cd Rates 2024

Understanding CD Rates: The Basics

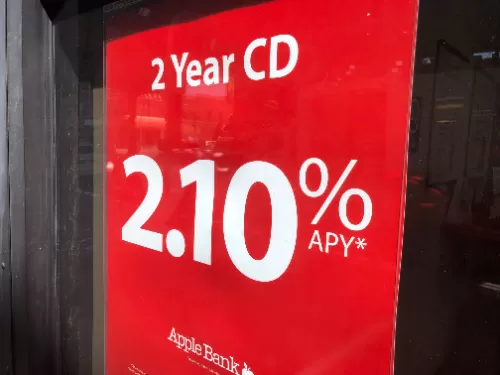

At its core, a Certificate of Deposit is a time-bound savings account that offers higher interest rates compared to traditional savings accounts. CD rates, determined by financial institutions, dictate the amount of interest you'll earn on your investment over a specific period, typically ranging from a few months to several years.

Comparing Rates: Finding the Best Deal

When exploring CD options, comparing rates is paramount. Different banks and credit unions offer varying rates based on factors such as market conditions, deposit amount, and term length. By researching and comparing rates from multiple institutions, you can identify the most competitive offers and maximize your earning potential.

Factors Influencing CD Rates

Several factors influence CD rates, including economic indicators, inflation rates, and central bank policies. In times of economic stability and low inflation, CD rates tend to be lower. Conversely, during periods of economic uncertainty or rising inflation, CD rates may increase to attract investors seeking safer investment options.

Strategies for Maximizing Returns

To capitalize on CD rates, consider employing strategic savings techniques. For instance, "laddering" involves dividing your investment across multiple CDs with staggered maturity dates. This strategy allows you to access funds periodically while taking advantage of potentially higher rates on longer-term CDs.

Navigating Rate Fluctuations

CD rates are subject to fluctuations based on market dynamics and economic trends. While locking in a favorable rate can provide stability and peace of mind, it's essential to remain flexible and adapt to changing conditions. Monitoring interest rate movements and staying informed about economic developments can help you make informed decisions about your CD investments.

Harnessing the Power of CD Rates

In the realm of personal finance, CD rates serve as a cornerstone of wealth-building strategies. By understanding how CD rates work, comparing offers, and employing savvy savings techniques, individuals can harness the power of CD investments to achieve their financial goals. Whether you're saving for a short-term objective or planning for long-term growth, navigating the terrain of CD rates is key to optimizing your savings journey.

Resolve financial strain, get cash loan instantlyIn our life, cash loan offer a fast and convenient solution, with a simple application process and efficient approval process making it easy to access funds. Ensuring privacy and offering flexible loan amounts and terms to meet individual needs, cash loans help tackle emergencies and achieve personal and family goals.

Resolve financial strain, get cash loan instantlyIn our life, cash loan offer a fast and convenient solution, with a simple application process and efficient approval process making it easy to access funds. Ensuring privacy and offering flexible loan amounts and terms to meet individual needs, cash loans help tackle emergencies and achieve personal and family goals. Top 10 HELOC Lenders for 2025As you own your home longer, pay down your mortgage, and make home improvements, you build equity. Just as your home was used as collateral for your original mortgage, that same equity can serve as collateral for future loans, known as HELOCs (Home Equity Lines of Credit).

Top 10 HELOC Lenders for 2025As you own your home longer, pay down your mortgage, and make home improvements, you build equity. Just as your home was used as collateral for your original mortgage, that same equity can serve as collateral for future loans, known as HELOCs (Home Equity Lines of Credit). Retirement Investment Tips for SeniorsAs you approach retirement age, ensuring your financial future is secure becomes a top priority. Smart investing can make a significant difference in your ability to enjoy a comfortable retirement. For middle-aged and older Americans, it’s not just about saving; it’s about making your money work for you in ways that will sustain you throughout your golden years. Whether you’re already in your 50s or planning ahead for your 60s or beyond, here are some practical retirement investment tips to help guide you toward financial security.

Retirement Investment Tips for SeniorsAs you approach retirement age, ensuring your financial future is secure becomes a top priority. Smart investing can make a significant difference in your ability to enjoy a comfortable retirement. For middle-aged and older Americans, it’s not just about saving; it’s about making your money work for you in ways that will sustain you throughout your golden years. Whether you’re already in your 50s or planning ahead for your 60s or beyond, here are some practical retirement investment tips to help guide you toward financial security.

Unlocking Opportunities: How to Secure Small Business Grants in the USAStarting or growing a small business in the USA can be challenging, but grants provide a valuable lifeline. Whether you're looking to expand, launch a startup, or recover from financial setbacks, small business grants can give you the boost you need without adding debt to your bottom line. This guide will help you navigate the process of applying for these grants and maximizing your chances of success.

Unlocking Opportunities: How to Secure Small Business Grants in the USAStarting or growing a small business in the USA can be challenging, but grants provide a valuable lifeline. Whether you're looking to expand, launch a startup, or recover from financial setbacks, small business grants can give you the boost you need without adding debt to your bottom line. This guide will help you navigate the process of applying for these grants and maximizing your chances of success. Changing Trade Show Booth Design Strategies That Convert Visitors in 2025The trade show landscape has transformed dramatically. In today's crowded exhibition halls, your booth needs to work harder than ever to capture attention and generate quality leads. This comprehensive guide reveals the proven strategies top brands are using to maximize their trade show ROI through innovative booth design.

Changing Trade Show Booth Design Strategies That Convert Visitors in 2025The trade show landscape has transformed dramatically. In today's crowded exhibition halls, your booth needs to work harder than ever to capture attention and generate quality leads. This comprehensive guide reveals the proven strategies top brands are using to maximize their trade show ROI through innovative booth design. Understanding Loans in the United States: A Comprehensive GuideWhen it comes to managing finances in the United States, loans play a crucial role in helping individuals achieve their goals, whether it's buying a home, funding education, or starting a business.

Understanding Loans in the United States: A Comprehensive GuideWhen it comes to managing finances in the United States, loans play a crucial role in helping individuals achieve their goals, whether it's buying a home, funding education, or starting a business. Analyzing the Pros and Cons of Cash LoansCash loans, also known as payday loans or cash advances, are a form of short-term borrowing that can provide quick access to funds for individuals facing financial emergencies. While these loans offer immediate relief, they also come with a set of advantages and disadvantages that borrowers should carefully consider before taking out a loan.

Analyzing the Pros and Cons of Cash LoansCash loans, also known as payday loans or cash advances, are a form of short-term borrowing that can provide quick access to funds for individuals facing financial emergencies. While these loans offer immediate relief, they also come with a set of advantages and disadvantages that borrowers should carefully consider before taking out a loan.