Related searches

Compare the best student loan rates and companies

Hard Cash Loan

Cash Loans Immediately

Same Day Cash Loans

Cash Loans in San Antonio tx

Instant Payday Loans Completely Online

They are designed to help individuals cover immediate financial needs until their next paycheck. This article will explore the basics of cash loans in the USA, their benefits and drawbacks, and what borrowers should consider before applying for one.

What is a Cash Loan?

A cash loan is a small, short-term unsecured loan, typically due on the borrower’s next payday. These loans are generally easy to access, requiring minimal paperwork and approval processes. They are often used for emergencies or unexpected expenses, such as medical bills, car repairs, or urgent home repairs. The amount that can be borrowed usually ranges from $100 to $1,000, depending on the lender and the borrower’s income.

How Do Cash Loans Work in the USA?

In the USA, cash loans are offered by various lenders, including payday loan stores, online lenders, and some credit unions. To apply for a cash loan, borrowers must provide proof of income, an active checking account, and identification. The application process is typically quick, and many lenders can approve loans within minutes. Once approved, the loan amount is deposited directly into the borrower’s bank account, usually within 24 hours.

Benefits of Cash Loans

Cash loans offer several benefits to borrowers:

Quick Access to Funds: One of the main advantages of cash loans is their speed. Borrowers can access the funds they need in a very short time, making them ideal for emergencies.

Minimal Requirements: Cash loans generally have fewer requirements than traditional loans. Most lenders do not require a high credit score, collateral, or lengthy application forms.

Flexibility: Borrowers can use the funds from a cash loan for any purpose, whether it’s covering a utility bill, medical expenses, or other unexpected costs.

Drawbacks of Cash Loans

While cash loans offer quick financial relief, they also come with significant drawbacks:

High Interest Rates and Fees: Cash loans often have very high interest rates and fees compared to traditional loans. The annual percentage rate (APR) can range from 300% to 700%, depending on the lender and state regulations.

Short Repayment Terms: Most cash loans are due on the borrower’s next payday, which can be challenging for those already facing financial difficulties. If the loan is not repaid on time, additional fees and interest can accumulate quickly.

Risk of Debt Cycle: Due to the high costs and short repayment terms, borrowers can easily fall into a cycle of debt, taking out new loans to pay off existing ones.

Alternatives to Cash Loans

Given the high costs associated with cash loans, it is important to consider alternatives:

Personal Loans: These are often available from banks and credit unions at lower interest rates and with more favorable terms than cash loans.

Credit Card Advances: While still expensive, credit card cash advances can be cheaper than cash loans if repaid quickly.

Borrowing from Friends or Family: This option might be more flexible and have lower or no interest.

Financial Assistance Programs: Many non-profit organizations offer assistance programs for those in financial distress, which can provide a better solution than a high-cost loan.

Conclusion

Cash loans in the USA provide quick financial relief for those in urgent need, but they come with high costs and risks. Borrowers should carefully consider their options and potential alternatives before committing to a cash loan. Understanding the terms, interest rates, and repayment schedules is crucial to avoiding the debt cycle and making the most of this financial tool.

Unlock Funding Opportunities: How to Secure Small Business Grants and LoansStarting and growing a small business can be challenging, especially when it comes to securing the necessary funding. Fortunately, a variety of small business grants and loans are available to help entrepreneurs build their dreams. In this guide, we’ll explore different types of small business grants and loans, how to apply for them, and what options are available for startups and established businesses alike.

Unlock Funding Opportunities: How to Secure Small Business Grants and LoansStarting and growing a small business can be challenging, especially when it comes to securing the necessary funding. Fortunately, a variety of small business grants and loans are available to help entrepreneurs build their dreams. In this guide, we’ll explore different types of small business grants and loans, how to apply for them, and what options are available for startups and established businesses alike. Personal loans: See options and apply onlinePersonal loans are versatile financial tools that can assist individuals in achieving their goals. Whether it's consolidating debt, financing a large purchase, or covering unexpected expenses, personal loans offer a flexible solution. Understanding the intricacies of personal loans is crucial for making informed financial decisions.

Personal loans: See options and apply onlinePersonal loans are versatile financial tools that can assist individuals in achieving their goals. Whether it's consolidating debt, financing a large purchase, or covering unexpected expenses, personal loans offer a flexible solution. Understanding the intricacies of personal loans is crucial for making informed financial decisions. Navigating Debt: Effective Solutions to Improve Your Financial HealthManaging debt can be overwhelming, but there are various ways to get help and improve your financial situation. From understanding the impact of paying a debt collector to finding free debt consolidation services, this guide provides valuable information to help you take control of your finances.

Navigating Debt: Effective Solutions to Improve Your Financial HealthManaging debt can be overwhelming, but there are various ways to get help and improve your financial situation. From understanding the impact of paying a debt collector to finding free debt consolidation services, this guide provides valuable information to help you take control of your finances.

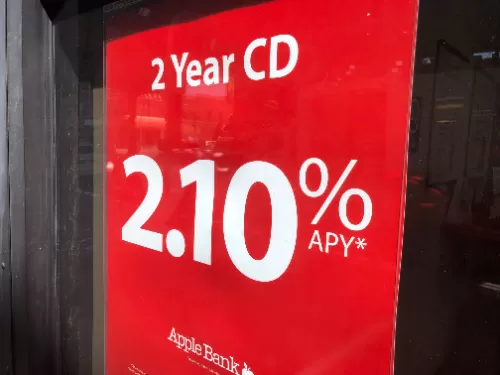

Navigating the Terrain of CD Rates: A Guide to Maximizing Your SavingsIn the realm of personal finance, Certificate of Deposit (CD) rates play a pivotal role in helping individuals grow their savings. Whether you're a seasoned investor or a newcomer to the world of financial planning, understanding CD rates is essential for making informed decisions about your money.

Navigating the Terrain of CD Rates: A Guide to Maximizing Your SavingsIn the realm of personal finance, Certificate of Deposit (CD) rates play a pivotal role in helping individuals grow their savings. Whether you're a seasoned investor or a newcomer to the world of financial planning, understanding CD rates is essential for making informed decisions about your money. How to Secure Funding When You Need It Most: A Guide to Business Grants and Financial SupportStarting a business or maintaining one can be challenging, especially when you’re struggling financially. You might find yourself thinking, “I’m poor and need money,” and wondering where to turn for help. Fortunately, there are several options available, including business grants, that can provide the necessary funding to get your venture off the ground or keep it afloat.

How to Secure Funding When You Need It Most: A Guide to Business Grants and Financial SupportStarting a business or maintaining one can be challenging, especially when you’re struggling financially. You might find yourself thinking, “I’m poor and need money,” and wondering where to turn for help. Fortunately, there are several options available, including business grants, that can provide the necessary funding to get your venture off the ground or keep it afloat. Protect Your Business: Essential Security Measures Every Company NeedsIn today’s digital age, business security is more important than ever. Cyber threats, data breaches, and physical theft pose serious risks to companies of all sizes. To ensure your business remains safe from external and internal threats, adopting a comprehensive security strategy is essential. Here are the key business security measures every company should implement.

Protect Your Business: Essential Security Measures Every Company NeedsIn today’s digital age, business security is more important than ever. Cyber threats, data breaches, and physical theft pose serious risks to companies of all sizes. To ensure your business remains safe from external and internal threats, adopting a comprehensive security strategy is essential. Here are the key business security measures every company should implement. Your Guide to Finding the Best Mortgage SolutionsAre you ready to buy a new home, refinance your current mortgage, or tap into your home’s equity? With so many options available, it can be overwhelming to know where to start. Don’t worry—we’ve got you covered! Here’s everything you need to know about finding the best mortgage lenders, rates, and services near you.

Your Guide to Finding the Best Mortgage SolutionsAre you ready to buy a new home, refinance your current mortgage, or tap into your home’s equity? With so many options available, it can be overwhelming to know where to start. Don’t worry—we’ve got you covered! Here’s everything you need to know about finding the best mortgage lenders, rates, and services near you.