Related searches

Instant Payday Loans Completely Online

Same Day Cash Loans

Cash Loans Immediately

Compare the best student loan rates and companies

Cash Loans in San Antonio tx

hard cash loan

Borrow Only What You Need: Before applying for a cash loan, assess your financial situation and borrow only the amount you need to cover the emergency expense. Avoid borrowing more than necessary, as it will only increase the cost of borrowing.

Understand the Terms: Take the time to read and understand the terms and conditions of the loan agreement. Pay attention to the interest rates, fees, repayment schedule, and any penalties for late payments or defaults.

Compare Lenders: Shop around and compare offers from different lenders to find the most favorable terms. Look for lenders with transparent pricing and reasonable fees. Avoid lenders who advertise unrealistic promises or charge excessive fees.

Have a Repayment Plan: Before taking out a cash loan, develop a repayment plan to ensure you can repay the loan on time. Consider your income and expenses to determine how much you can afford to repay each month without causing financial strain.

Avoid Rollovers: Rolling over a cash loan by extending the repayment period may seem like a temporary solution, but it can lead to a cycle of debt with escalating fees and interest charges. Always strive to repay the loan on time to avoid additional costs.

Seek Financial Counseling: If you're struggling with debt or facing financial difficulties, seek advice from a reputable financial counselor. They can provide guidance on managing debt, budgeting, and finding alternative solutions to financial problems.

Build an Emergency Fund: To avoid relying on cash loans in the future, work on building an emergency fund to cover unexpected expenses. Set aside a portion of your income each month until you have enough savings to handle emergencies without resorting to borrowing.

By following these tips, borrowers can make informed decisions and borrow cash loans responsibly. While cash loans can provide temporary relief in emergencies, it's essential to approach borrowing with caution and prioritize financial stability in the long term.

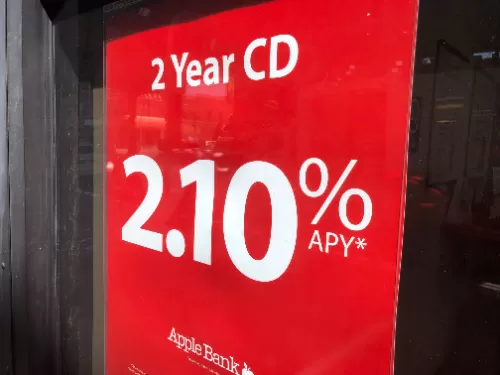

Navigating the Terrain of CD Rates: A Guide to Maximizing Your SavingsIn the realm of personal finance, Certificate of Deposit (CD) rates play a pivotal role in helping individuals grow their savings. Whether you're a seasoned investor or a newcomer to the world of financial planning, understanding CD rates is essential for making informed decisions about your money.

Navigating the Terrain of CD Rates: A Guide to Maximizing Your SavingsIn the realm of personal finance, Certificate of Deposit (CD) rates play a pivotal role in helping individuals grow their savings. Whether you're a seasoned investor or a newcomer to the world of financial planning, understanding CD rates is essential for making informed decisions about your money. Navigating the Realm of Personal LoansPersonal loans serve as versatile financial tools, catering to a myriad of needs, from debt consolidation to unexpected expenses. For individuals seeking the best personal loans for debt consolidation, options abound, including those offered by reputable institutions like Discover.

Navigating the Realm of Personal LoansPersonal loans serve as versatile financial tools, catering to a myriad of needs, from debt consolidation to unexpected expenses. For individuals seeking the best personal loans for debt consolidation, options abound, including those offered by reputable institutions like Discover. The Power of Mortgage LoansIn the journey towards homeownership, mortgage loans serve as the key that unlocks the door to your dream home, providing the financial means to turn aspirations into reality. Let's delve into the world of mortgage loans and discover how they empower individuals and families to achieve their homeownership goals with confidence and ease.

The Power of Mortgage LoansIn the journey towards homeownership, mortgage loans serve as the key that unlocks the door to your dream home, providing the financial means to turn aspirations into reality. Let's delve into the world of mortgage loans and discover how they empower individuals and families to achieve their homeownership goals with confidence and ease.

Unlock Your Business Potential: Top Small Business Financing Options in the USAStarting and growing a small business requires not only passion and dedication but also access to the right funding. Whether you're launching a startup or looking to expand your existing venture, understanding the best small business funding options is crucial. In this article, we'll explore the most sought-after business financing solutions in the USA, including startup business funding, competitive business loan rates, and fast online loan approvals to help you secure the capital you need.

Unlock Your Business Potential: Top Small Business Financing Options in the USAStarting and growing a small business requires not only passion and dedication but also access to the right funding. Whether you're launching a startup or looking to expand your existing venture, understanding the best small business funding options is crucial. In this article, we'll explore the most sought-after business financing solutions in the USA, including startup business funding, competitive business loan rates, and fast online loan approvals to help you secure the capital you need. Revolutionize Your Borrowing Experience with Cutting-Edge Loan AppsIn the fast-paced world of finance, staying ahead means embracing innovation, and loan apps are at the forefront of this revolution. These dynamic mobile applications offer a seamless and efficient way to access credit, putting the power of borrowing directly into your hands. Let's dive into the realm of loan apps and discover how they can transform your borrowing experience for the better.

Revolutionize Your Borrowing Experience with Cutting-Edge Loan AppsIn the fast-paced world of finance, staying ahead means embracing innovation, and loan apps are at the forefront of this revolution. These dynamic mobile applications offer a seamless and efficient way to access credit, putting the power of borrowing directly into your hands. Let's dive into the realm of loan apps and discover how they can transform your borrowing experience for the better. The Ultimate Guide to Debt Help in the U.S.: From Counseling to ReliefDebt help is an essential service for millions of Americans struggling with financial difficulties. With rising living costs, credit card debt, student loans, medical bills, and mortgages, many individuals find themselves overwhelmed by debt. Fortunately, there are various strategies and resources available to help people regain control of their finances and avoid falling deeper into financial distress.

The Ultimate Guide to Debt Help in the U.S.: From Counseling to ReliefDebt help is an essential service for millions of Americans struggling with financial difficulties. With rising living costs, credit card debt, student loans, medical bills, and mortgages, many individuals find themselves overwhelmed by debt. Fortunately, there are various strategies and resources available to help people regain control of their finances and avoid falling deeper into financial distress. Maximizing Your Savings with High Yield CD AccountsFinding the best savings options in today’s financial market can be challenging. High-yield CD (Certificate of Deposit) accounts offer a safe, reliable way to grow your money. Here’s how to find the best online CD rates and maximize your returns with the right choice.

Maximizing Your Savings with High Yield CD AccountsFinding the best savings options in today’s financial market can be challenging. High-yield CD (Certificate of Deposit) accounts offer a safe, reliable way to grow your money. Here’s how to find the best online CD rates and maximize your returns with the right choice.