Related searches

Accc Debt Management

Finance Consumer Services

United Consumer Finance

Santander Consumer Finance

Consumer Finance Protection Bureau

Consumer Financing Companies

Understanding the Consumer Finance Protection Bureau

The Consumer Finance Protection Bureau (CFPB) is a key resource for anyone looking to better understand their financial rights. This government agency was created to protect consumers from unfair financial practices and ensure transparency in financial transactions. Seniors can turn to the CFPB for guidance on various issues, including loans, credit cards, and mortgages. By staying informed about the resources available through the Consumer Finance Protection Bureau, you can make more educated decisions about your finances.

Exploring United Consumer Finance

United Consumer Finance is one of the many consumer financing companies that provide financial products tailored to meet the needs of consumers. They offer a range of services, including personal loans, installment loans, and lines of credit. For seniors looking for flexible financing options, understanding how United Consumer Finance operates can be beneficial. Their services are designed to be accessible, helping individuals manage their expenses without overwhelming debt.

The Importance of Finance Consumer Services

When it comes to managing personal finances, finance consumer services can make a significant difference. These services encompass various financial planning tools, budgeting assistance, and debt management programs. For seniors, utilizing finance consumer services can help maintain financial stability during retirement years. Whether it’s budgeting for healthcare costs or understanding social security benefits, these services provide crucial support.

Debt Management with ACCC

For those struggling with debt, organizations like ACCC Debt Management offer valuable assistance. They specialize in helping consumers develop effective debt management strategies. The ACCC Debt Management program provides resources and guidance for negotiating with creditors, consolidating debts, and creating a budget that works. Engaging with ACCC Debt Management can help seniors regain control of their financial situation, allowing for a more secure and worry-free retirement.

Conclusion

Understanding consumer finance is essential for older adults in the U.S. By leveraging resources like the Consumer Finance Protection Bureau, exploring options with United Consumer Finance, and utilizing finance consumer services, seniors can make informed financial decisions. Additionally, seeking help from organizations such as ACCC Debt Management can provide the support needed to manage debt effectively. With the right knowledge and resources, you can navigate the world of consumer finance and secure a stable financial future.

The Rise of Cosmetic Surgery Loans: A Controversial TrendIn recent years, a rise in the popularity of cosmetic surgery, fueled in part by the availability of cosmetic surgery loans. These loans, which are specifically designed to cover the cost of cosmetic procedures, have sparked debate and controversy in hole society.

The Rise of Cosmetic Surgery Loans: A Controversial TrendIn recent years, a rise in the popularity of cosmetic surgery, fueled in part by the availability of cosmetic surgery loans. These loans, which are specifically designed to cover the cost of cosmetic procedures, have sparked debate and controversy in hole society. Understanding Cash Loans in the USACash loans, also known as payday loans or short-term loans, are a popular financial product in the United States.

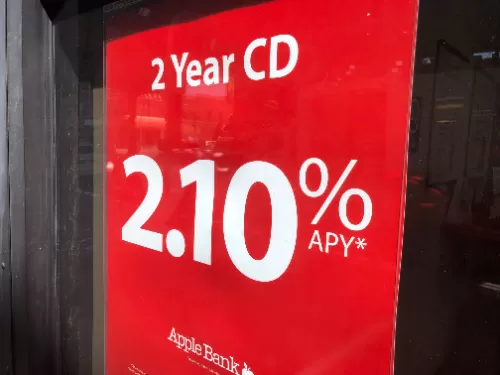

Understanding Cash Loans in the USACash loans, also known as payday loans or short-term loans, are a popular financial product in the United States. Navigating the Terrain of CD Rates: A Guide to Maximizing Your SavingsIn the realm of personal finance, Certificate of Deposit (CD) rates play a pivotal role in helping individuals grow their savings. Whether you're a seasoned investor or a newcomer to the world of financial planning, understanding CD rates is essential for making informed decisions about your money.

Navigating the Terrain of CD Rates: A Guide to Maximizing Your SavingsIn the realm of personal finance, Certificate of Deposit (CD) rates play a pivotal role in helping individuals grow their savings. Whether you're a seasoned investor or a newcomer to the world of financial planning, understanding CD rates is essential for making informed decisions about your money.

Maximize Your Savings: Discover the Best High Interest Accounts and Safe Investment OptionsAre you looking for ways to grow your savings while minimizing risks? Whether you're searching for the best savings accounts or safe places to invest your money, this guide will help you navigate the top options available today.

Maximize Your Savings: Discover the Best High Interest Accounts and Safe Investment OptionsAre you looking for ways to grow your savings while minimizing risks? Whether you're searching for the best savings accounts or safe places to invest your money, this guide will help you navigate the top options available today. How Much Could You Earn from Equity Release in the UKAre you sitting on a gold mine? For many UK homeowners over 55, the answer could be a resounding "Yes!" Thanks to equity release, tapping into the hidden wealth tied up in your property is not just possible; it's a financial game-changer, providing substantial funds to enhance your retirement.

How Much Could You Earn from Equity Release in the UKAre you sitting on a gold mine? For many UK homeowners over 55, the answer could be a resounding "Yes!" Thanks to equity release, tapping into the hidden wealth tied up in your property is not just possible; it's a financial game-changer, providing substantial funds to enhance your retirement. Navigating Debt: Effective Solutions to Improve Your Financial HealthManaging debt can be overwhelming, but there are various ways to get help and improve your financial situation. From understanding the impact of paying a debt collector to finding free debt consolidation services, this guide provides valuable information to help you take control of your finances.

Navigating Debt: Effective Solutions to Improve Your Financial HealthManaging debt can be overwhelming, but there are various ways to get help and improve your financial situation. From understanding the impact of paying a debt collector to finding free debt consolidation services, this guide provides valuable information to help you take control of your finances. Unlocking Opportunities with Small Business Grants: A Complete GuideStarting and growing a small business can be challenging, especially when funding is limited. Thankfully, there are several grant opportunities available to help small businesses thrive. This guide explores the various options, from federal to minority-specific grants, to help you find the best funding opportunities.

Unlocking Opportunities with Small Business Grants: A Complete GuideStarting and growing a small business can be challenging, especially when funding is limited. Thankfully, there are several grant opportunities available to help small businesses thrive. This guide explores the various options, from federal to minority-specific grants, to help you find the best funding opportunities.